City council approves motion to reverse tobogganing ban at 45 hills

Posted February 7, 2024 7:14 pm.

Last Updated February 7, 2024 11:24 pm.

Despite the lack of snow this winter, Torontonians can now go tobogganing on any of the 45 hills the city previously deemed “unsafe.”

Toronto City Council voted 21-3 in favour of removing its tobogganing ban, reversing a Jan. 14 directive that banned the activity on a select number of hills because of the possible risk of injury due to the obstruction of trees, ditches, trails, and fences.

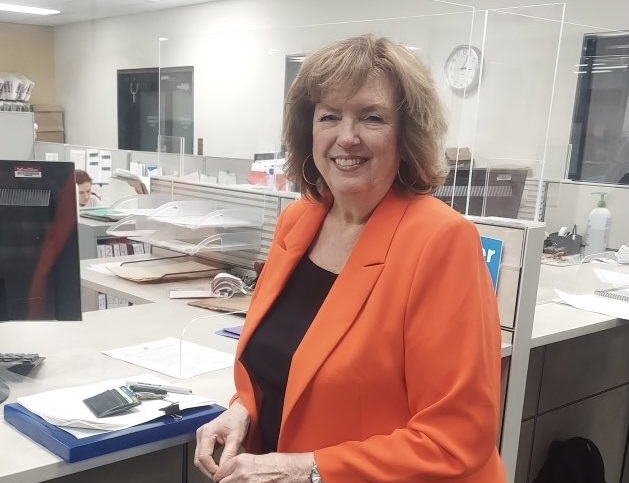

Councillors Mike Colle (Eglinton-Lawrence), Stephen Holyday (Etobicoke Centre) and Gord Perks (Parkdale-High Park) were the three who voted against the motion.

“I want to make the change to permit tobogganing today,” said councillor Brad Bradford on Wednesday.

Wednesday’s motion will see the city remove signs prohibiting tobogganing and install new warning signs about the potential risks, along with information about the designated tobogganing hills in the city.

“We have a lot of park staff across the city so there is no shortage of resources to get out there to take [the old signs] down. Then, frankly, put the safety measures in place that we used to [have].”

In addition to replacing the signage, city crews will reintroduce hay bales that were previously in place at hills where tobogganing was previously prohibited.

Councillors were also informed that any changes to the tobogganing program would increase the City’s exposure to liability for any injuries sustained.

The motion also calls for local councillors to be consulted and approval obtained from Community Council before tobogganing is prohibited on any hill.

10 PER CENT FOREIGN BUYERS MUNICIPAL TAX

City council also voted 24-1 to approve a 10 per cent tax on foreign buyers to deter real estate speculation within the city.

An Executive Committee report last month said the tax would “safeguard and enhance the availability of residential housing supply” while maintaining a level of affordability by discouraging international buyers from purchasing property.

The 10 per cent levy would be on top of the current 25 per cent being charged by the province for its own Non-Resident Speculation Tax. The province has collected more than $1 billion since it introduced its tax in 2017, half of which came from purchases in Toronto.

The city report claims its tax is expected to generate $9.6 million in revenue and up to $15 million if the federal government lifts its foreign buyer ban at the end of 2024.

Holyday was the only dissenting vote, saying the city doesn’t need to be pouring more fuel on the “dumpster fire” that is its finances at this time. He also raised concerns that professional athletes, such as Toronto Blue Jays, Raptors, and Maple Leafs players, who purchase property in the city could be hit with the tax because they are not permanent residents.

TORONTO ISLAND PROPERTY TAX RATES

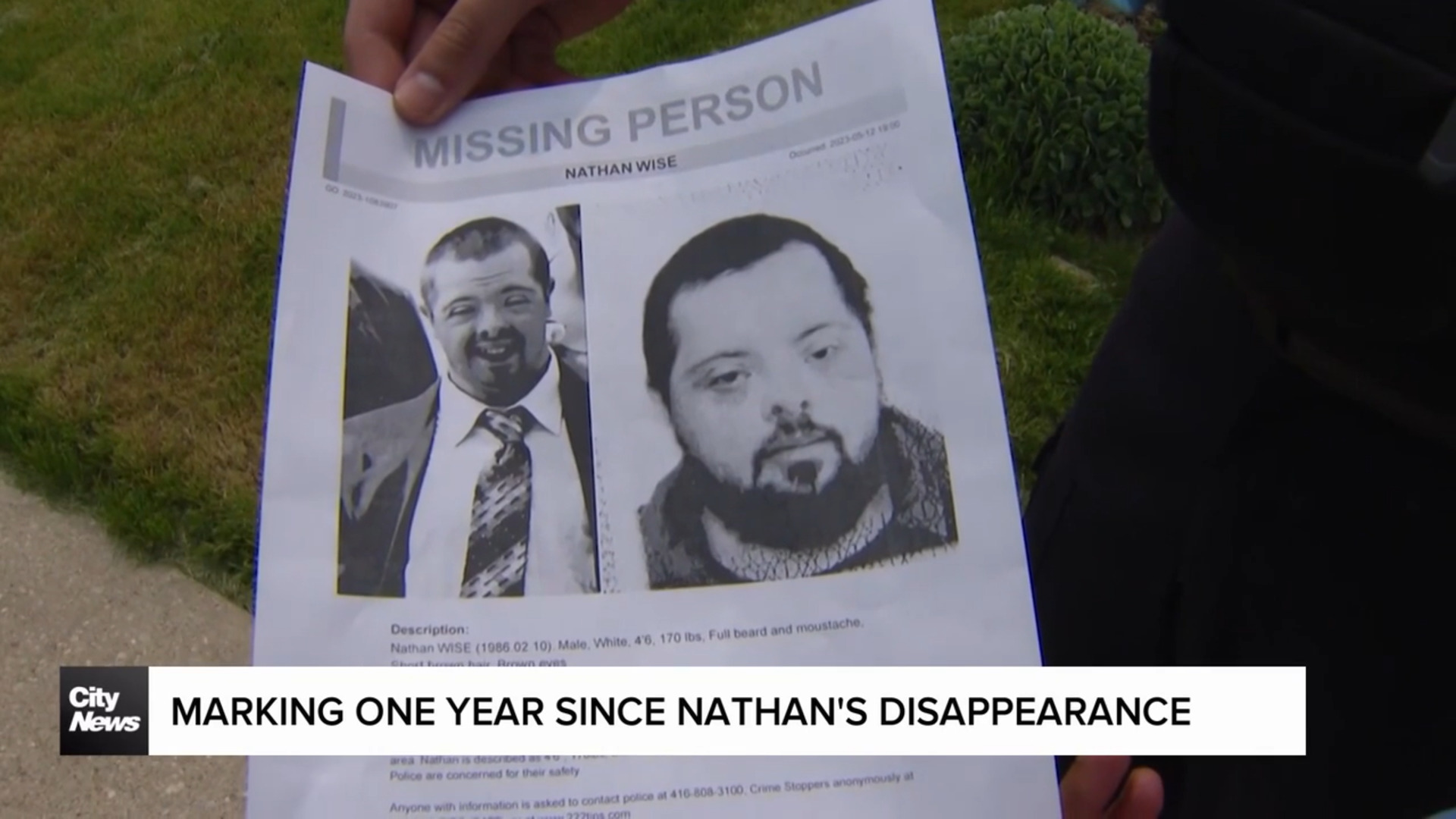

City council rejected a motion calling for a review of the residential property tax rate of Toronto Islanders.

Coun. John Burnside brought forth the motion, saying Toronto Island residents are not “paying their fair share” when it comes to property taxes compared to other Toronto residents.

Burnside noted that Island residents own the house they live in but not the land it sits on as that is leased from the City. Therefore their property taxes are “extremely low” as they are based solely on the house value and not the land it sits on.

“For example, the average Toronto Island homeowner pays approximately $1,530 per year, whereas the average Flemingdon Park tenant pays $4,320 of property tax annually in their rent,” said Burnside’s motion.

However, councillors voted 15-11 against bringing his motion forward, sending it instead to the Executive Committee for further discussion.

With files from Lucas Casaletto of CityNews