Inflation rate cools in August but grocery prices continue to climb

Posted September 20, 2022 8:48 am.

Last Updated September 20, 2022 12:17 pm.

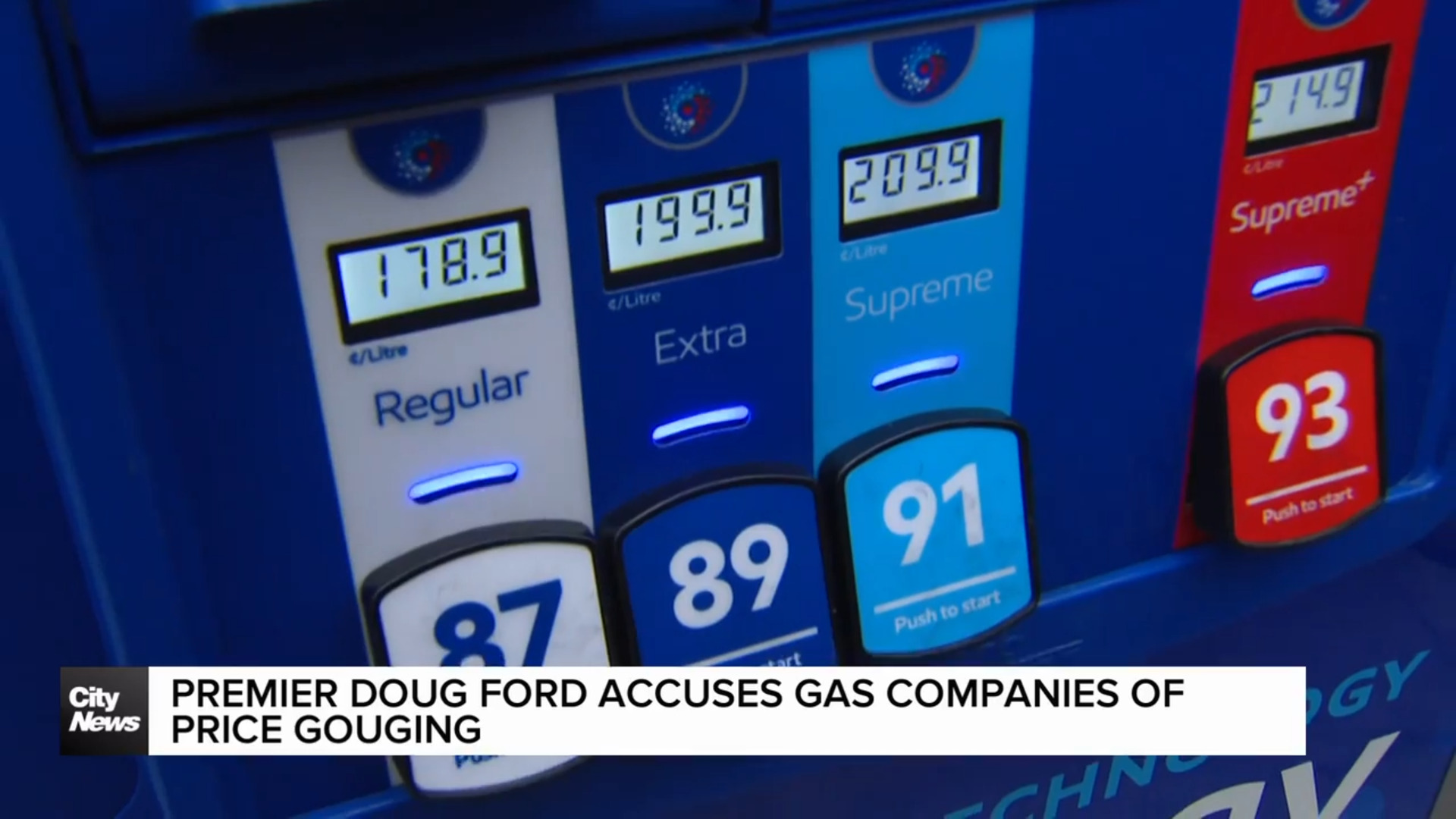

Canada’s annual inflation rate slowed to 7.0 per cent in August largely driven by the price of gasoline falling, but the cost of groceries continues to climb.

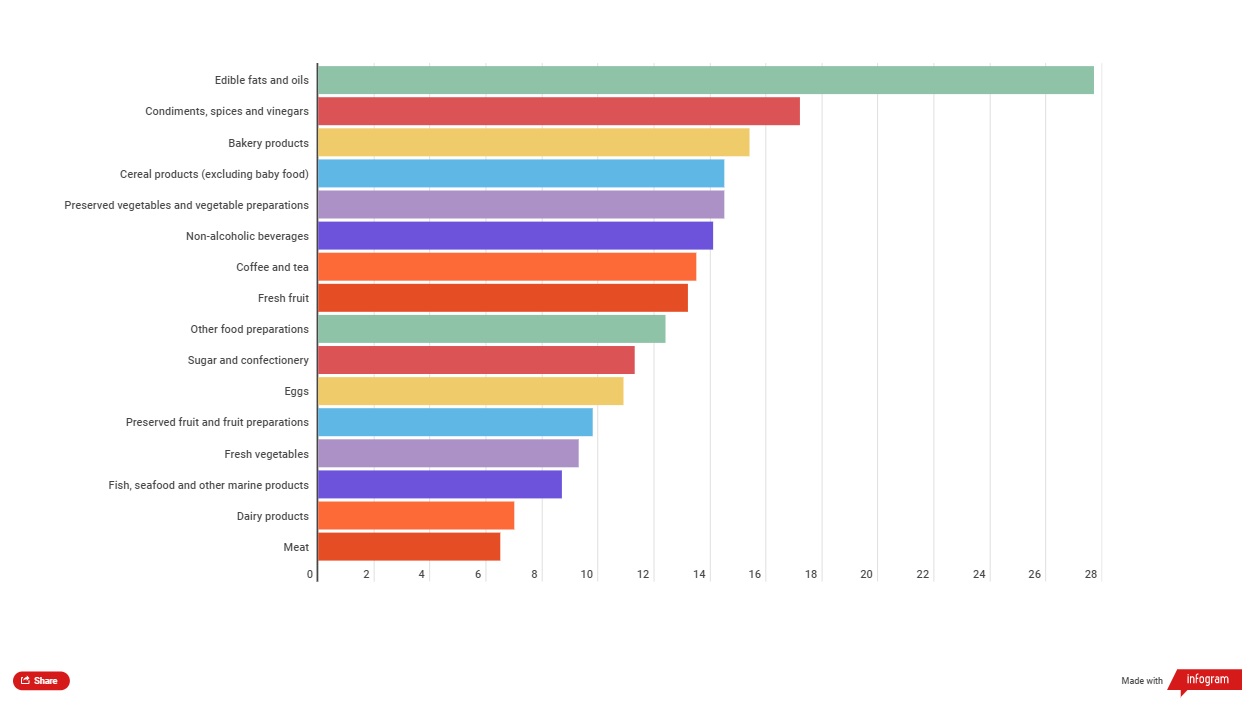

In its latest monthly consumer price index (CPI) report, Statistics Canada said grocery prices rose at the fastest rate since 1981, with prices up 10.8 per cent compared with a year ago.

#Breaking Canada inflation rate slows to 7% y/y increase in August (est. up 7.3%)

-Grocery costs jump 10.8% y/y (biggest gain since 1981)

-Gas prices ease m/m.

-Core CPI at 5.23%— Mike Eppel (@eppman) September 20, 2022

Still, the national year-over-year inflation cooled more than economists predicted.

The federal agency said transportation and shelter prices drove the deceleration in consumer prices.

Gas prices were up 22.1 per cent in August compared with a year ago, but down 18.8 per cent since June.

On a monthly basis, overall consumer prices were slightly lower in August than in July.

Statistics Canada said the 0.3 per cent decline in the CPI from July to August is the largest monthly decline since the early months of the pandemic.

Related: Canada’s inflation rate slows to 7.6% in July as gas prices fall

Excluding gasoline prices, year-over-year inflation was 6.3 per cent, making August the first month since June 2021 where annual inflation excluding gasoline has slowed.

Still, the cost of living remains stubbornly high for Canadians, who are largely feeling the pinch at the grocery store.

The federal agency attributes the acceleration in food prices to continued supply chain disruptions, the Russian invasion of Ukraine, extreme weather, and higher input costs.

Prices for bakery goods were up 15.4 per cent while prices fresh fruit was 13.2 per cent higher than a year ago.

Canadians are paying more for many grocery items. The bar graph shows a 12-month percentage change in the latest inflation report for August 2022.

(Data source: Statistics Canada)

The gap between inflation and wages is narrowing, with average hourly wages up 5.4 per cent in August.

The Bank of Canada will be paying close attention to its preferred measures of core inflation, which tend to be less volatile and help the bank see through temporary changes in the consumer price index. Those measures all point to a slowdown in annual inflation in August as well.

Earlier this month, the Bank of Canada raised its key interest rate for the fifth time this year, as it continues to battle hot inflation with higher interest rates.

The bank is set to make its next rate announcement on Oct. 26 and has warned more interest rate hikes are needed to bring inflation to its two per cent target.